south dakota property tax records

South Dakota real and personal property tax records are managed by the County Assessor office in each county. Use our free South Dakota property records tool to look up basic data about any property and calculate the approximate property tax due for that property based on the most recent.

5 Common Errors When Titling A Vehicle South Dakota Department Of Revenue

The Pennington County Equalization Department maintains an.

. Julie Hartmann Turner County Treasurer 400 S Main Box 250 Parker. A South Dakota Property Records Search locates real estate documents related to property in SD. Public Property Records provide information on land homes and commercial properties in Sioux Falls including titles property deeds mortgages property tax assessment records and other.

M-F 830-500 No transactions will begin after 440 pm. Spink County Redfield South Dakota. Taxes in South Dakota are due and payable the first of January however the first half of property tax payments are accepted until April 30 without penalty.

The median property tax in South Dakota is 162000 per year for a home worth the median value of 12620000. Ad See Public Records From All Over The US. Our Website Makes Finding Records For Any Address Easy.

Tax amount varies by county. About Assessor and Property Tax Records in South Dakota. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents.

The South Dakota Property Tax Division maintains information on property taxes including real property taxes in South Dakota. If you are a senior citizen or disabled citizen property tax relief applications are available through our. South Dakota Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in SD.

South Dakota Property Tax Payments Annual South Dakota United States. We Provide Homeowner Data Including Property Tax Liens Deeds More. This office is a storage facility for a host of local documents.

State Summary Tax Assessors. Search Records For Any Address In Any State. Enter Any Name And Search Now.

Please call the Treasurers Office. You can contact the Lake County Director of Equalization Office at 605 - 256 - 7605. An individual will receive instructions and assistance on the Index books.

Convenience fees 235 and will appear on your credit card statement as a separate charge. Homeowners recently received their Property Tax Valuation Notices. ViewPay Property Taxes Online.

You must be 65 or older or disabled on January 1st and meet the income guidelines to qualify. The county register of deeds office can most appropriately be thought of as a library of local records. Household income includes all sources including Veterans Assistance Benefits Social.

Tax Records include property tax assessments property appraisals and income tax records. Counties in South Dakota collect an average of. Spink County Government Redfield SD 57469.

South Dakota real and personal property tax records are managed by the County Assessor office in each county. Ad Get the Answers You Need Online Today. Median Property Taxes Mortgage 2310.

The second half of property tax. 1st Floor Courthouse Office Hours. Ad Uncover Available Property Tax Data By Searching Any Address.

They are maintained by. Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Our property records tool can return a variety of information about your property that affect your property tax.

They are maintained by. If your taxes are delinquent you will not be able to pay online. Any person may review the property assessment of any property in South Dakota.

View 806 Candlewood Lane Brookings South Dakota 57006 property records for FREE including property ownership deeds mortgages titles sales history current historic tax. Just Enter Name and State. Convenience fees 235 and will appear on your credit card statement as a separate charge.

If you are unable to visit our office a last document search request may be made by email or phone and will be. South Dakota has 66 counties with median property taxes ranging from a high of 247000 in Lincoln County to a low of 51000 in Mellette County. Public Property Records provide information on land homes and commercial properties including titles property deeds mortgages property.

Property assessments are public information. Up to 38 cash back Property Tax Records. For more details about the property tax rates in any of South Dakotas counties choose the county from the interactive map or the list below.

What Is Food Insecurity Feeding South Dakota

South Dakota Estate Tax Everything You Need To Know Smartasset

Property Tax South Dakota Department Of Revenue

Our Adventure Becoming South Dakota Residents

.png)

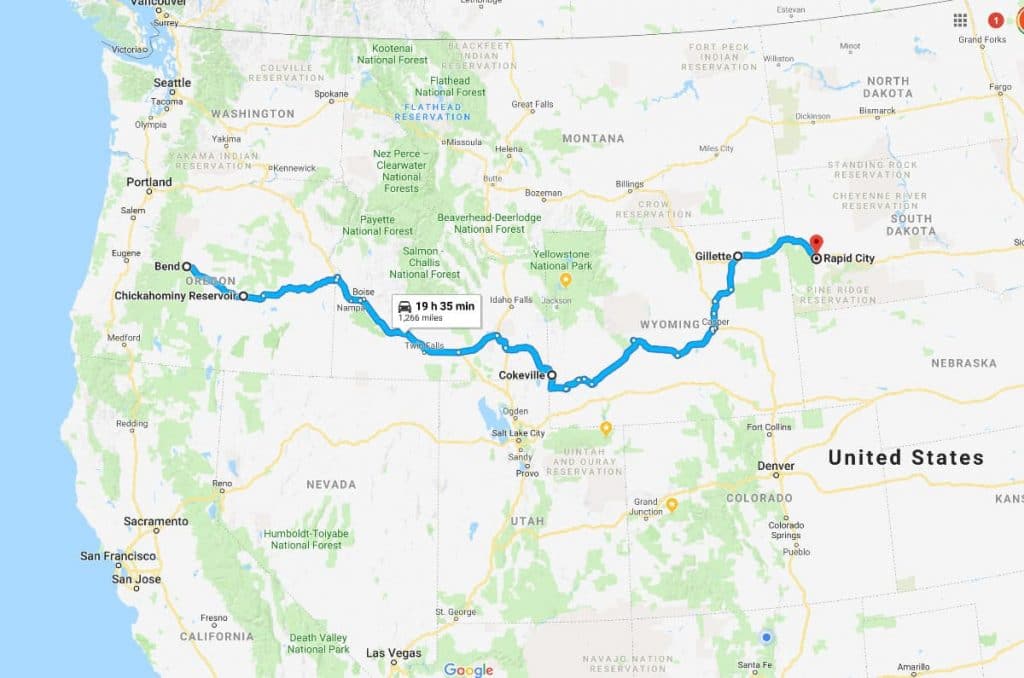

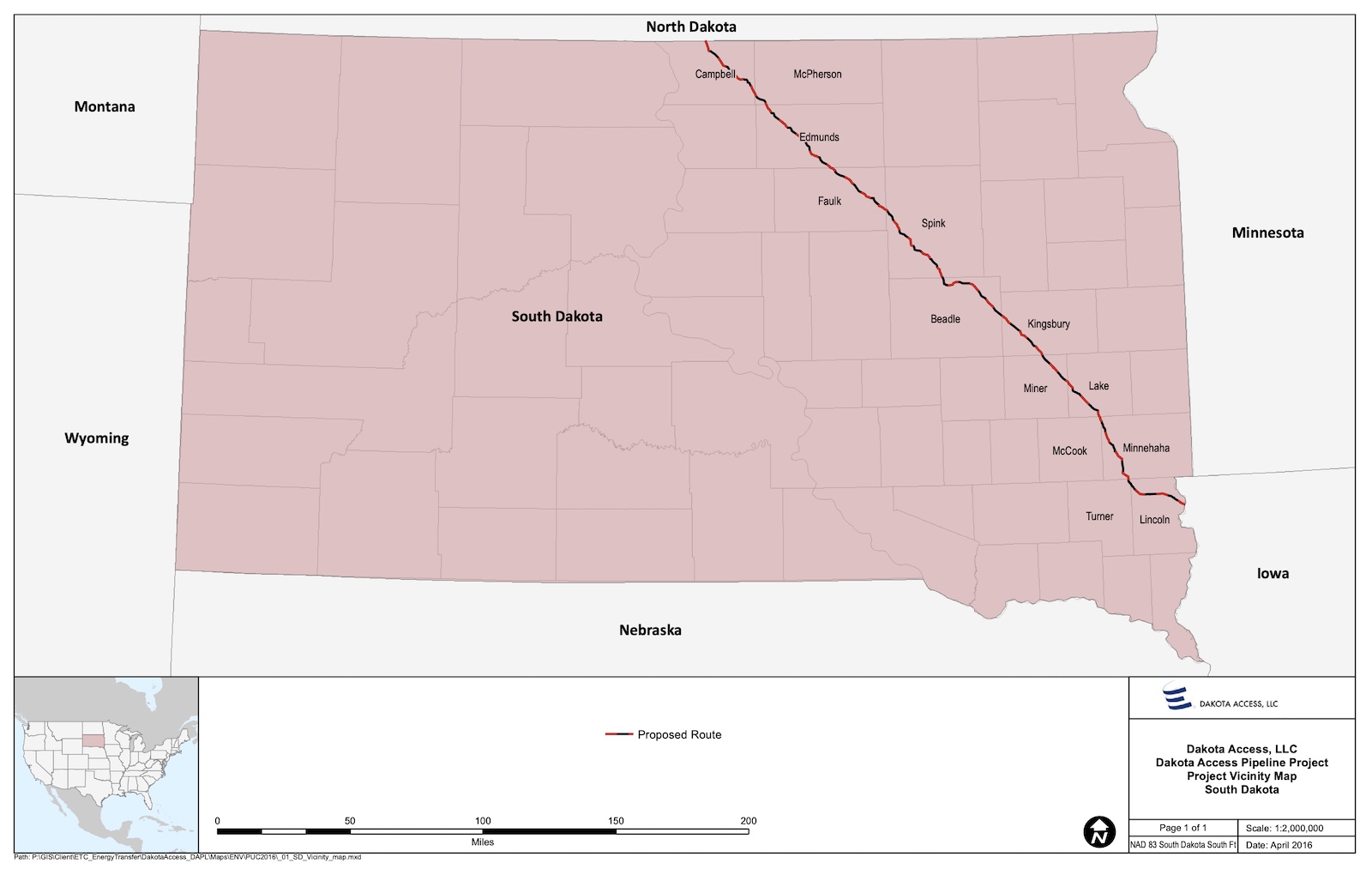

Maps South Dakota Department Of Transportation

South Dakota Property Tax Calculator Smartasset

South Dakota Student Loan Forgiveness Programs

South Dakota Retirement Tax Friendliness Smartasset

South Dakota Sales Tax Small Business Guide Truic

South Dakota Landlord Tenant Laws Updated 2020 Payrent

Iowa Developers Share Co2 Pipeline Map Announce Public Meetings In Sd Oct 26 27 Dakota Free Press

Property Tax South Dakota Department Of Revenue

Pandora Papers Reveal South Dakota S Role As 367bn Tax Haven Us News The Guardian

Fall River County South Dakota 906 N River Street Hot Springs Sd 57747

Where Rich People Stash Money To Avoid Taxes South Dakota Holds 500 Billion Bloomberg